Asia Pacific Automotive Steel Wheels Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Rim Size (13–15 Inches, 16–18 Inches, 19–21 Inches, and More than 21 Inches), Vehicle Type (Heavy Commercial Vehicle, Light Commercial Vehicle, and Passenger Vehicle), and End User (OEM and Aftermarket)

Market Introduction

Asia Pacific includes countries such as China, Japan, India, Australia, South Korea and Rest of Asia Pacific. Rapid developments, digitalization of the economy, adequate government support, increasing education awareness, and rising incomes of the middle class are some of the attributable factors that have ensured smooth transition of these economies from the developing stage towards a developed stage. The growing economies of the region are leading to the growth in wide variety of sectors, such as manufacturing, technology, and various others. The prominent sectors of growth in the Asian countries include manufacturing sector, electronics & semiconductor sector, and the automotive sector. The above three sectors are also heavily dependent on the usage of automated material handling systems in order to ensure optimum material handling costs, increased employee safety and increased efficiency of the overall supply chain.

Raw materials for manufacturing industries are present in abundance in the region and as a result the Asian nations have been building up to become high-skilled manufacturing hubs. The functioning of supply chain in the manufacturing industry plays a critical role in determining the cost of the finished product for the end-user. As the Asian nations aim to become competitive manufacturers, integration of advanced solutions into the manufacturing and supply chain processes is inevitable. With adequate government support and presence of skilled labor at lower costs, Asia Pacific nations have the potentials of dominating the manufacturing industry vertical in a short period of time. While Japan, China, India, Singapore, and Vietnam are automotive manufacturing hubs in the Asia Pacific region; countries such as Taiwan, South Korea, China, Japan, Vietnam, and Hong Kong dominate the semiconductor and electronics manufacturing industry. FDI in the automotive manufacturing as well as electronics & semiconductor manufacturing has further propelled the industry sectors to prosper at unprecedented rates.

The technology expend in manufacturing in Asia Pacific would grow looking at the companies that take stock of the existing investments in order to ensure that the value has been delivered. Moreover, new spends have been concentrated towards operational efficiencies, like ‘factories of the future’ investments and novel business models such as products as a service, subsequently boosting the demand growth for automated material handling equipment market in the Asia Pacific region.

Get more information on this report :

Market Overview and Dynamics

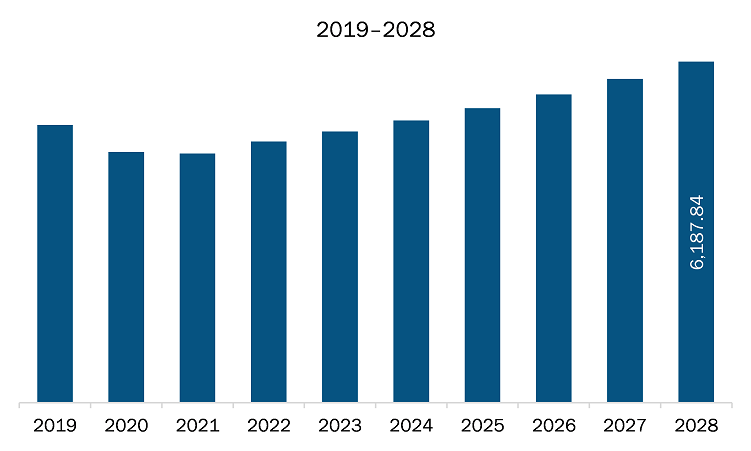

The Automotive Steel Wheels Market in APAC is expected to grow from US$ 4547.65 Million in 2020 to US$ 6187.84 Million by 2028; it is estimated to grow at a CAGR of 4.6% from 2021-2028. The Surge in Demand for Lightweight Steel Wheels is driving the market growth. Automobile wheels are made from materials such as steel, aluminum, magnesium, carbon fiber, and other metal combinations. Parameters such as of size, weight, material, and designs contribute significantly to wheel performance. Wheel weight has a vital role in the movement and performance of cars, trucks, buses, and bikes, among others. Lower the weight of the wheel lesser the overall weight of vehicles, and this helps improve fuel consumption. Owing to the properties of steel which is easy to manufacturing, durability, and easy repairability has preference by the customers using hardcore sport utility vehicles SUVs, city cars and heavy goods vehicle (HMVs). Due to the heavy loads and rough tracks the wheels of the vehicles are expected to damaged. The steel wheels are easier to repair and replace than wheels made from alloys and aluminum; moreover, the repair costs of the former ones are lower than the other types. The production cost of steels wheels is 70–80% lower than the cost of production of alloy wheels. Therefore, steel wheels are being used in many of the economy cars worldwide.

Asia Pacific countries are expecting to witness a huge challenge due to growing COVID-19. Due to the outbreak of disease, healthcare industries have been affected severely, considering the economic conditions in the current situation. Due to increasing coronavirus cases of COVID-19 in the region after its first case in December 2019 in Wuhan, China, the COVID-19 virus has spread to at least 180 countries and other regions. Asia Pacific region is characterized by the presence of a large number of developing countries, positive economic outlook, high industrial presence, and huge population. The high growth rate of urbanization and industrialization in developing countries of Asia Pacific region is anticipated to offer ample growth opportunities to the market players operating in the APAC automotive steel wheel market. Logistics is amongst the prominent industries in Asian economy due to rising e-commerce, however COVID-19 has impacted the supply chain of many industries. However, due to government’s measures to reduce the effects coronavirus outbreak by announcing lockdowns, travel and trade bans has disturbed the performance of supply chain to some extent. Disturbed logistics industry has witnessed minimal adoption of advanced technologies during the time of lockdown. All these measures are expected to have a negative impact on the demand of automated steels wheels in this region especially in 2020.

Key Market Segments

The APAC automotive steel wheels market is segmented based on rims size, vehicle type, end user and country. Based market is segmented as Rim Size 13-15 Inches, 16-18 Inches, 19-21 Inches, and more than 21 Inches. In 2020, the 16-18 Inch segment held the largest share APAC automotive steel wheels market. Based on vehicle type the automotive steel wheels market is divided into Heavy Commercial Vehicle, Light Commercial Vehicle, and Passenger Vehicle. Passenger Vehicle is expected to the fastest growing segment over the forecast period. On the basis of user the market is segmented into OEM, and Aftermarket. The OEM segment accounts for largest market share in the 2020.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the Automotive Steel Wheels Market in APAC are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Topy Industries limited, Steel Strips Wheels limited, Klassic Wheels Ltd., SHANGHAI BAOSTEEL AUTOPARTS CO. LTD IOCHPE-MAXION SA, Accuride Corporation.

Reasons to buy report

- To understand the APAC Automotive Steel Wheels Market landscape and identify market segments that are most likely to guarantee a strong return

- Stay ahead of the race by comprehending the ever-changing competitive landscape for APAC Automotive Steel Wheels Market

- Efficiently plan M&A and partnership deals in APAC Automotive Steel Wheels Market by identifying market segments with the most promising probable sales

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form APAC Automotive Steel Wheels Market

- Obtain market revenue forecast for market by various segments from 2021-2028 in APAC region.

APAC Automotive Steel Wheels Market SEGMENTATION

APAC Automotive Steel Wheels Market – By Rim Size

- 13-15 Inches

- 16-18 Inches

- 19-21 Inches

- More than 21 inches

APAC Automotive Steel Wheels Market – By Vehicle Type

- Heavy Commercial Vehicle

- Light Commercial Vehicle

- Passenger Vehicle

APAC Automotive Steel Wheels Market – By End User

- OEM

- Aftermarket

APAC Automotive Steel Wheels Market – By Country

- Australia

- China

- India

- Japan

- South Korea

- Rest of APAC

APAC Automotive Steel Wheels Market -Companies Mentioned

- Topy Industries limited

- Steel Strips Wheels limited

- Klassic Wheels Ltd.

- SHANGHAI BAOSTEEL AUTOPARTS CO. LTD

- IOCHPE-MAXION SA

- Accuride Corporation

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 Automotive Steel Wheels Market – By Rim Size

1.3.2 Automotive Steel Wheels Market – By Vehicle Type

1.3.3 Automotive Steel Wheels Market – By End User

1.3.4 APAC Automotive Steel Wheels Market – By Country

2. APAC Automotive Steel Wheels Market – Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. APAC Automotive Steel Wheels – Market Landscape

4.1 Overview

4.2 PEST Analysis

4.2.1 APAC PEST Analysis

4.3 Ecosystem Analysis

4.4 Expert Opinion

5. APAC Automotive Steel Wheels Market– Industry Dynamics

5.1 Market Drivers

5.1.1 Surge in Demand for Lightweight Steel Wheels

5.1 Market Restraints

5.1.1 Booming Popularity of Alloy Wheels

5.2 Market Opportunities

5.2.1 Enactment of Steel Wheels in Electric Power Vehicles

5.3 Future Trends

5.3.1 Technological growth in Manufacturing of Automotive Wheels

5.4 Impact analysis

6. Automotive Steel Wheels Market – APAC Analysis

6.1 APAC Automotive Steel Wheels Market Overview

6.2 APAC Automotive Steel Wheels Market – Revenue and Forecast to 2028 (US$ Million)

7. APAC Automotive Steel Wheels Market Analysis and Forecast to 2028 – by Rim Size

7.1 Overview

7.2 APAC Automotive Steel Wheels Market, by Rim Size, 2020 & 2028 (% Share)

7.3-15 Inches

7.3.1 Overview

7.3.2-15 Inches: APAC Automotive Steel Wheels Market Revenue and Forecast to 2028 (US$ Mn)

7.4-18 Inches

7.4.1 Overview

7.4.2-18 Inches: APAC Automotive Steel Wheels Market Revenue and Forecast to 2028 (US$ Mn)

7.5-21 Inches

7.5.1 Overview

7.5.2-21 Inches: Automotive Steel Wheels Market Revenue and Forecast to 2028 (US$ Mn)

7.6 More than 21 Inches

7.6.1 Overview

7.6.2 More than 21 Inches: APAC Automotive Steel Wheels Market Revenue and Forecast to 2028 (US$ Mn)

8. APAC Automotive Steel Wheels Market Analysis and Forecast to 2028 – Vehicle Type

8.1 Overview

8.2 Automotive Steel Wheels Market, by Vehicle Type, 2020 & 2028 (% Share)

8.3 Heavy Commercial Vehicle

8.3.1 Overview

8.3.2 Heavy Commercial Vehicle: APAC Automotive Steel Wheels Market Revenue and Forecast to 2028 (US$ Mn)

8.4 Light Commercial Vehicle

8.4.1 Overview

8.4.2 Light Commercial Vehicle: APAC Automotive Steel Wheels Market Revenue and Forecast to 2028 (US$ Mn)

8.5 Passenger Vehicle

8.5.1 Overview

8.5.2 Passenger Vehicle: APAC Automotive Steel Wheels Market Revenue and Forecast to 2028 (US$ Mn)

9. APAC Automotive Steel Wheels Market Analysis and Forecast to 2028 – End User

9.1 Overview

9.2 APAC Automotive Steel Wheels Market, by End User, 2020 & 2028 (% Share)

9.3 OEM (Original Equipment Manufacturers)

9.3.1 Overview

9.3.2 OEM: APAC Automotive Steel Wheels Market Revenue and Forecast to 2028 (US$ Mn)

9.4 Aftermarket

9.4.1 Overview

9.4.2 Aftermarket: APAC Automotive Steel Wheels Market Revenue and Forecast to 2028 (US$ Mn)

10. APAC Automotive Steel Wheels Market Revenue and Forecast to 2028 Country Analysis

10.1 Asia Pacific: Automotive Steel Market

10.1.1 Overview

10.1.2 Asia Pacific: Automotive Steel Wheels Market - Revenue and Forecast to 2028 (USD Million)

10.1.3 Asia Pacific: Automotive Steel Wheels Market, By Country

10.1.3.1 China: Automotive Steel Wheels Market – Revenue and Forecast to 2028 (US$ Million)

10.1.3.1.1 China: Automotive Steel Wheels Market, By Rim Size

10.1.3.1.2 China: Automotive Steel Wheels Market, By Vehicle Type

10.1.3.1.3 China: Automotive Steel Wheels Market, By End-User

10.1.3.2 India: Automotive Steel Wheels Market – Revenue and Forecast to 2028 (US$ Million)

10.1.3.2.1 India: Automotive Steel Wheels Market, By Rim Size

10.1.3.2.2 India: Automotive Steel Wheels Market, By Vehicle Type

10.1.3.2.3 India: Automotive Steel Wheels Market, By End-User

10.1.3.3 Japan: Automotive Steel Wheels Market – Revenue and Forecast to 2028 (US$ Million)

10.1.3.3.1 Japan: Automotive Steel Wheels Market, By Rim Size

10.1.3.3.2 Japan: Automotive Steel Wheels Market, By Vehicle Type

10.1.3.3.3 Japan: Automotive Steel Wheels Market, By End-User

10.1.3.4 South Korea: Automotive Steel Wheels Market – Revenue and Forecast to 2028 (US$ Million)

10.1.3.4.1 South Korea: Automotive Steel Wheels Market, By Rim Size

10.1.3.4.2 South Korea: Automotive Steel Wheels Market, By Vehicle Type

10.1.3.4.3 South Korea: Automotive Steel Wheels Market, By End-User

10.1.3.5 Australia: Automotive Steel Wheels Market – Revenue and Forecast to 2028 (US$ Million)

10.1.3.5.1 Australia: Automotive Steel Wheels Market, By Rim Size

10.1.3.5.2 Australia: Automotive Steel Wheels Market, By Vehicle Type

10.1.3.5.3 Australia: Automotive Steel Wheels Market, By End-User

10.1.3.6 Rest of Asia Pacific: Automotive Steel Wheels Market – Revenue and Forecast to 2028 (US$ Million)

10.1.3.6.1 Rest of Asia Pacific: Automotive Steel Wheels Market, By Rim Size

10.1.3.6.2 Rest of Asia Pacific: Automotive Steel Wheels Market, By Vehicle Type

10.1.3.6.3 Rest of Asia Pacific: Automotive Steel Wheels Market, By End-User

11. Impact Of COVID-19 Pandemic on APAC Automotive Steel Wheels Market

11.1 Asia-Pacific: Impact Assessment of COVID-19 Pandemic

12. Industry Landscape

12.1 Strategy and Business Planning

12.2 Product News

12.3 Partnerships & Collaboration

13. Company Profiles

13.1 TOPY INDUSTRIES LIMITED

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 STEEL STRIPS WHEELS LIMITED

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 SHANGHAI BAOSTEEL AUTOPARTS CO. LTD.

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 Klassic Wheels Ltd.

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 IOCHPE-MAXION SA

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Accuride Corporation

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

14. Appendix

14.1 About The Insight Partners

14.2 Glossary of Terms

LIST OF TABLES

Table 1. Automotive Steel Wheels Market – Revenue and Forecast to 2027 (US$ Million)

Table 2. China: Automotive Steel Wheels Market, By Rim Size – Revenue and Forecast to 2028 (US$ Million)

Table 3. China: Automotive Steel Wheels Market, By Vehicle Type – Revenue and Forecast to 2028 (US$ Million)

Table 4. China: Automotive Steel Wheels Market, By End-User – Revenue and Forecast to 2028 (US$ Million)

Table 5. India: Automotive Steel Wheels Market, By Rim Size – Revenue and Forecast to 2028 (USD Million)

Table 6. India: Automotive Steel Wheels Market, by Vehicle Type – Revenue and Forecast to 2028 (USD Million)

Table 7. India: Automotive Steel Wheels Market, by End-User – Revenue and Forecast to 2028 (USD Million)

Table 8. Japan: Automotive Steel Wheels Market, By Rim Size – Revenue and Forecast to 2028 (USD Million)

Table 9. Japan: Automotive Steel Wheels Market, by Vehicle Type – Revenue and Forecast to 2028 (USD Million)

Table 10. Japan: Automotive Steel Wheels Market, by End-User – Revenue and Forecast to 2028 (USD Million)

Table 11. South Korea: Automotive Steel Wheels Market, By Rim Size – Revenue and Forecast to 2028 (US$ Million)

Table 12. South Korea: Automotive Steel Wheels Market, by Vehicle Type – Revenue and Forecast to 2028 (USD Million)

Table 13. South Korea: Automotive Steel Wheels Market, by End-User – Revenue and Forecast to 2028 (USD Million)

Table 14. Australia: Automotive Steel Wheels Market, by Rim Size – Revenue and Forecast to 2028 (USD Million)

Table 15. Australia: Automotive Steel Wheels Market, by Vehicle Type– Revenue and Forecast to 2028 (US$ Million)

Table 16. Australia: Automotive Steel Wheels Market, by End-User – Revenue and Forecast to 2028 (USD Million)

Table 17. Rest of Asia Pacific: Automotive Steel Wheels Market, By Rim Size – Revenue and Forecast to 2028 (USD Million)

Table 18. Rest of Asia Pacific: Automotive Steel Wheels Market, by Vehicle Type – Revenue and Forecast to 2028 (USD Million)

Table 19. Rest of Asia Pacific: Automotive Steel Wheels Market, by End-User – Revenue and Forecast to 2028 (USD Million)

Table 20. Glossary of Terms, Automotive Steel Wheels Market

LIST OF FIGURES

Figure 1. APAC Automotive Steel Wheels Market Segmentation

Figure 2. APAC Automotive Steel Wheels Market – By Country

Figure 3. APAC Automotive Steel Wheels Market Overview

Figure 4.-15 Inch Rim Size Segment Held Largest Share of Automotive Steel Wheels Market in 2020

Figure 5. Automotive Steel Wheels Market in China Region to Show Remarkable Growth During Forecast Period

Figure 6. APAC Automotive Steel Wheels Market, By Country (US$ Million)

Figure 7. APAC: PEST Analysis

Figure 8. Ecosystem Analysis

Figure 9. Expert Opinion

Figure 10. APAC Automotive Steel Wheels Market Impact Analysis of Driver and Restraints

Figure 11. APAC Automotive Steel Wheels Market – Revenue and Forecast to 2027 (US$ Million)

Figure 12. APAC Automotive Steel Wheels Market, By Rim Size, 2020 & 2028 (% Share)

Figure 13.-15 Inches Market Revenue and Forecast to 2028 (US$ Mn)

Figure 14.-18 Inches Market Revenue and Forecast to 2028 (US$ Mn)

Figure 15.-21 Inches Market Revenue and Forecast to 2028 (US$ Mn)

Figure 16. More than 21 Inches: Automotive Steel Wheels Market Revenue and Forecast to 2028 (US$ Mn)

Figure 17. Automotive Steel Wheels Market, By Vehicle Type, 2020 & 2028 (% Share)

Figure 18. Heavy Commercial Vehicle: APAC Automotive Steel Wheels Market Revenue and Forecast to 2028 (US$ Mn)

Figure 19. Light Commercial Vehicle: APAC Automotive Steel Wheels Market Revenue and Forecast to 2028 (US$ Mn)

Figure 20. Passenger Vehicle: APAC Automotive Steel Wheels Market Revenue and Forecast to 2028 (US$ Mn)

Figure 21. APAC Automotive Steel Wheels Market, By End User, 2020 & 2028 (% Share)

Figure 22. OEM: APAC Automotive Steel Wheels Market Revenue and Forecast to 2028 (US$ Mn)

Figure 23. Aftermarket: APAC Automotive Steel Wheels Market Revenue and Forecast to 2028 (US$ Mn)

Figure 24. Asia Pacific: Automotive Steel Wheels Market Revenue Share, By Country (2020 and 2028)

Figure 25. China: Automotive Steel Wheels Market – Revenue and Forecast to 2028 (US$ Million)

Figure 26. India: Automotive Steel Wheels Market – Revenue and Forecast to 2028 (US$ Million)

Figure 27. Japan: Automotive Steel Wheels Market – Revenue and Forecast to 2028 (US$ Million)

Figure 28. South Korea: Automotive Steel Wheels Market – Revenue and Forecast to 2028 (US$ Million)

Figure 29. Australia: Automotive Steel Wheels Market – Revenue and Forecast to 2028 (US$ Million)

Figure 30. Rest of Asia Pacific: Automotive Steel Wheels Market – Revenue and Forecast to 2028 (US$ Million)

Figure 31. Impact of COVID-19 Pandemic in Asia Pacific Country Markets

The List of Companies- Asia Pacific Automotive Steel Wheels Market

- Topy Industries limited

- Steel Strips Wheels limited

- Klassic Wheels Ltd.

- SHANGHAI BAOSTEEL AUTOPARTS CO. LTD

- IOCHPE-MAXION SA

- Accuride Corporation

- To understand the APAC Automotive Steel Wheels Market landscape and identify market segments that are most likely to guarantee a strong return

- Stay ahead of the race by comprehending the ever-changing competitive landscape for APAC Automotive Steel Wheels Market

- Efficiently plan M&A and partnership deals in APAC Automotive Steel Wheels Market by identifying market segments with the most promising probable sales

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form APAC Automotive Steel Wheels Market

- Obtain market revenue forecast for market by various segments from 2021-2028 in APAC region.