Asia Pacific Automotive Electrical Connector Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Type (Cable Lugs, Battery Clamps, High Voltage Busbars, and Fuse Boxes), Vehicle Type [Passenger cars, Light Commercial Vehicle (LCV), & Medium and Heavy Commercial Vehicle (M&HCV)], and Powertrain Type [Internal Combustion Engine (ICE), Electric Vehicle (EV), Plug-In Hybrid Electric Vehicle (PHEV), and Hybrid Electric Vehicle (HEV)]

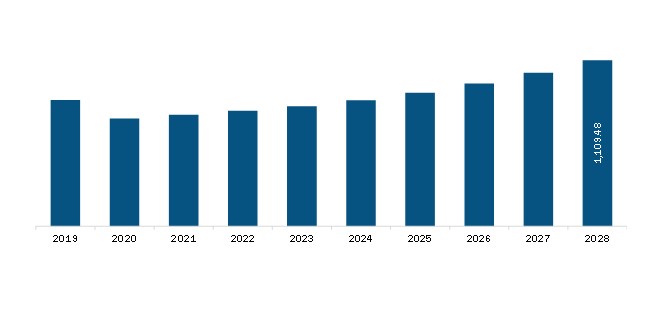

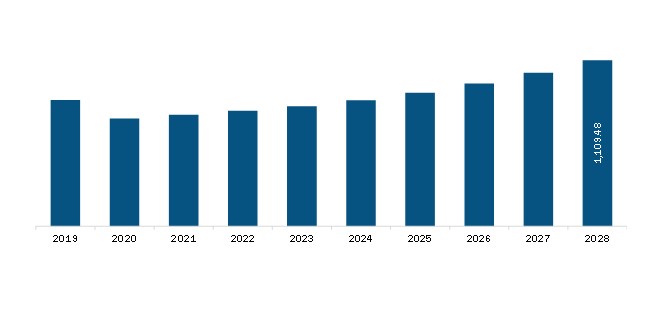

The Asia Pacific automotive electrical connector market is expected to reach US$ 1,109.48 million by 2028 from US$ 553.75 million in 2021; it is estimated to grow at a CAGR of 10.4% from 2021 to 2028.

Rising development in battery systems and increasing electrification of vehicles across the globe are boosting the market growth. However, a continuous decline in vehicle production volume is expected to restrict the market growth during the forecast period.

Increasing electrification in vehicles creates the demand for advanced batteries with high power output to provide sufficient power for all systems. Every vehicle comprises various electrical systems that require a specific amount of energy to perform tasks, owing to which the demand for electrical connectors is increasing. Hybrid electric vehicles (HEVs) and electric vehicles (EVs) rely on large-capacity battery packs, robust electric motor drives, and power inverters to distribute power. Specific types of connectors, including cables, busbars, and wires, are required to provide the battery's power to other vehicle systems. Traditional cable lugs, busbars, and other components are being replaced with high voltage connectors to meet battery power standards.

With the increasing battery power capacity and output, the demand for supporting connectors is also rising. For instance, Rogers Power Electronics Solutions (PES) offers a range of ROLINX busbar solutions for advanced battery technologies used in hybrid and electric vehicles. The improved battery technology for electricity is creating a massive opportunity for the automotive electrical connectors market. Further, lightweight busbars with high voltages are being developed for high-energy battery packs, delivering power to e-axles, e-motors, and other devices. The increasing battery capacity to provide sufficient power for the vehicle systems is creating a huge opportunity for the connector manufacturers to develop new busbars, cable lugs, and fuse boxes for smooth power transmission.

The containment measure taken by the governments in this region have negatively affected automotive and electronics sectors. China is the leading manufacturing country in this region and is among the worst-hit countries, along with India, which has ultimately impacted the production of automotive and electronics equipment. Further, due to the interruption in supply chain and logistics, the procurement rate of various automotive and electronics equipment, including hardware components of electric vehicle actuators, was quite affected. India, South Korea, Japan, Vietnam, and others have witnessed a sharp decline in the production of automotive and electric vehicles sectors.

The year-to-date volume sales of vehicles and automobiles have declined in the Asian economies. COVID-19 had a drastic impact on vehicle markets during the first half of 2020; however, it resulted in a different impact on each of the countries within the region. In China, the peak of the pandemic reached in February 2020. This led to new car sales dropping close to zero. However, the Chinese vehicle market witnessed a robust recovery and has now reached pre-COVID-19 levels. On the other hand, COVID-19 proved to be a bane for the entire automotive industry in countries such as Japan, India, Australia, and other Southeast Asian countries.

APAC is a global manufacturing hub with countries such as China, Japan, South Korea, and India leading the global manufacturing industry growth. The ongoing COVID-19 is anticipated to cause huge disruptions in the growth of various industries in the region. For instance, China is the global hub of manufacturing and the largest raw material supplier for various industries, and it is one of the worst affected countries due to COVID-19. Hence, the ongoing disruptions in the supply of raw materials and components, as well as the demand from China and other Asian countries, are expected to impact the growth of the automotive electrical connectors market in the coming quarters.

Asia Pacific Automotive Electrical Connector Market Revenue and Forecast to 2028 (US$ Mn)

Get more information on this report :

ASIA PACIFIC AUTOMOTIVE ELECTRICAL CONNECTOR MARKET SEGMENTATION

By Type

- Cable Lugs

- Battery Clamps

- High Voltage Busbars

- Fuse Boxes

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicle (LCV)

- Medium and Heavy Commercial Vehicle (M&HCV)

By Powertrain Type

- Pharmaceutical Industry

- Biotechnology Industry

- Medical Device Manufacturers

- Hospitals

- Others

By Country

- Australia

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

Company Profiles

- INTERCABLE srl

- Connor Manufacturing

- Amphenol Corporation

- Emerson Electric Co.

- Rogers Corporation

- Molex, LLC

- TB&C

- Difvan

- TE Connectivity Ltd

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Automotive Electrical Connectors Market Landscape

4.1 Market Overview

4.2 PEST Analysis

4.2.1 Asia-Pacific – PEST Analysis

4.3 Ecosystem Analysis

5. Automotive Electrical Connectors Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Rising Electrification of Vehicles

5.1.2 Improving Power Distribution Architecture

5.2 Market Restraints

5.2.1 Continuous Decline in Vehicle Production Volume

5.3 Market Opportunities

5.3.1 Rising Development in Battery Systems

5.4 Future Trends

5.4.1 Increasing Demand for Electric Vehicles

5.5 Impact Analysis of Drivers and Restraints

6. Automotive Electrical Connectors –Asia Pacific Market Analysis

6.1 Automotive Electrical Connectors Market Revenue Forecast and Analysis

7. Automotive Electrical Connectors Market Revenue and Forecast to 2028 – By Type

7.1 Overview

7.2 Automotive Electrical Connectors Market, by Type (2020 & 2028)

7.3 Cable Lugs

7.3.1 Overview

7.3.2 Cable Lugs: Automotive Electrical Connectors Market Revenue and Forecast to 2028 (US$ Million)

7.4 Battery Clamps

7.4.1 Overview

7.4.2 Battery Clamps: Automotive Electrical Connectors Market Revenue and Forecast to 2028 (US$ Million)

7.5 High Voltage Busbars

7.5.1 Overview

7.5.2 High Voltage Busbars: Automotive Electrical Connectors Market Revenue and Forecast to 2028 (US$ Million)

7.6 Fuse Boxes

7.6.1 Overview

7.6.2 Fuse Boxes: Automotive Electrical Connectors Market Revenue and Forecast to 2028 (US$ Million)

8. Automotive Electrical Connectors Market Analysis and Forecast to 2028 – By Vehicle Type

8.1 Overview

8.2 Automotive Electrical Connectors Market, by Vehicle Type (2020 & 2028)

8.3 Passenger Vehicle

8.3.1 Overview

8.3.2 Passenger Vehicle: Automotive Electrical Connectors Market Revenue and Forecast to 2028 (US$ Million)

8.4 Light Commercial Vehicle (LCV)

8.4.1 Overview

8.4.2 Light Commercial Vehicle (LCV): Automotive Electrical Connectors Market Revenue and Forecast to 2028 (US$ Million)

8.5 Medium and Heavy Commercial Vehicle (M&HCV)

8.5.1 Overview

8.5.2 Medium and Heavy Commercial Vehicle (M&HCV): Automotive Electrical Connectors Market Revenue and Forecast to 2028 (US$ Million)

9. Automotive Electrical Connectors Market Analysis and Forecast to 2028 – By Powertrain Type

9.1 Overview

9.2 Automotive Electrical Connectors Market, by Powertrain Type (2020 & 2028)

9.3 Internal combustion engine (ICE)

9.3.1 Overview

9.3.2 Internal Combustion Engine (ICE): Automotive Electrical Connectors Market Revenue and Forecast to 2028 (US$ Million)

9.4 Electric Vehicle (EV)

9.4.1 Overview

9.4.2 Electric Vehicle (EV): Automotive Electrical Connectors Market Revenue and Forecast to 2028 (US$ Million)

9.5 Plug-in Hybrid Electric Vehicle (PHEV)

9.5.1 Overview

9.5.2 Plug-In Hybrid Electric Vehicle (PHEV): Automotive Electrical Connectors Market Revenue and Forecast to 2028 (US$ Million)

9.6 Hybrid Electric Vehicle (HEV)

9.6.1 Overview

9.6.2 Hybrid Electric Vehicle (HEV): Automotive Electrical Connectors Market Revenue and Forecast to 2028 (US$ Million)

10. Asia Pacific Automotive Electrical Connectors Market –Country Analysis

10.1 APAC: Automotive Electrical Connectors Market

10.1.1 APAC: Automotive Electrical Connectors Market – Revenue and Forecast to 2028 (US$ Million)

10.1.2 APAC: Automotive Electrical Connectors Market, by Type

10.1.3 APAC: Automotive Electrical Connectors Market, by Vehicle Type

10.1.4 APAC: Automotive Electrical Connectors Market, by Powertrain Type

10.1.5 APAC: Automotive Electrical Connectors Market, by Key Country

10.1.5.1 China: Automotive Electrical Connectors Market – Revenue and Forecast to 2028 (US$ Million)

10.1.5.1.1 China: Automotive Electrical Connectors Market, by Type

10.1.5.1.2 China: Automotive Electrical Connectors Market, by Vehicle Type

10.1.5.1.3 China: Automotive Electrical Connectors Market, by Powertrain Type

10.1.5.2 Japan: Automotive Electrical Connectors Market – Revenue and Forecast to 2028 (US$ Million)

10.1.5.2.1 Japan: Automotive Electrical Connectors Market, by Type

10.1.5.2.2 Japan: Automotive Electrical Connectors Market, by Vehicle Type

10.1.5.2.3 Japan: Automotive Electrical Connectors Market, by Powertrain Type

10.1.5.3 India: Automotive Electrical Connectors Market – Revenue and Forecast to 2028 (US$ Million)

10.1.5.3.1 India: Automotive Electrical Connectors Market, by Type

10.1.5.3.2 India: Automotive Electrical Connectors Market, by Vehicle Type

10.1.5.3.3 India: Automotive Electrical Connectors Market, by Powertrain Type

10.1.5.4 South Korea: Automotive Electrical Connectors Market – Revenue and Forecast to 2028 (US$ Million)

10.1.5.4.1 South Korea: Automotive Electrical Connectors Market, by Type

10.1.5.4.2 South Korea: Automotive Electrical Connectors Market, by Vehicle Type

10.1.5.4.3 South Korea: Automotive Electrical Connectors Market, by Powertrain Type

10.1.5.5 Australia: Automotive Electrical Connectors Market – Revenue and Forecast to 2028 (US$ Million)

10.1.5.5.1 Australia: Automotive Electrical Connectors Market, by Type

10.1.5.5.2 Australia: Automotive Electrical Connectors Market, by Vehicle Type

10.1.5.5.3 Australia: Automotive Electrical Connectors Market, by Powertrain Type

10.1.5.6 Rest of APAC: Automotive Electrical Connectors Market – Revenue and Forecast to 2028 (US$ Million)

10.1.5.6.1 Rest of APAC: Automotive Electrical Connectors Market, by Type

10.1.5.6.2 Rest of APAC: Automotive Electrical Connectors Market, by Vehicle Type

10.1.5.6.3 Rest of APAC: Automotive Electrical Connectors Market, by Powertrain Type

11. Automotive Electrical Connectors Market - COVID-19 Impact Analysis

11.1 Asia-Pacific: Impact Assessment of COVID-19 Pandemic

12. Industry Landscape

12.1 Overview

12.2 Market Initiative: Expansion

12.3 Mergers and Acquisitions

13. Company Profiles

13.1 INTERCABLE srl

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 Connor Manufacturing

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Amphenol Corporation

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 Emerson Electric Co.

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 Rogers Corporation

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Molex, LLC

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 TB&C

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 difvan

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 TE Connectivity Ltd.

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

14. Appendix

14.1 About The Insight Partners

14.2 Word Index

LIST OF TABLES

Table 1. APAC: Automotive Electrical Connectors Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 2. APAC: Automotive Electrical Connectors Market, by Vehicle Type – Revenue and Forecast to 2028 (US$ Million)

Table 3. APAC: Automotive Electrical Connectors Market, by Powertrain Type – Revenue and Forecast to 2028 (US$ Million)

Table 4. APAC: Automotive Electrical Connectors Market, by Country – Revenue and Forecast to 2028 (US$ Million)

Table 5. China: Automotive Electrical Connectors Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 6. China: Automotive Electrical Connectors Market, by Vehicle Type – Revenue and Forecast to 2028 (US$ Million)

Table 7. China: Automotive Electrical Connectors Market, by Powertrain Type – Revenue and Forecast to 2028 (US$ Million)

Table 8. Japan: Automotive Electrical Connectors Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 9. Japan: Automotive Electrical Connectors Market, by Vehicle Type – Revenue and Forecast to 2028 (US$ Million)

Table 10. Japan: Automotive Electrical Connectors Market, by Powertrain Type – Revenue and Forecast to 2028 (US$ Million)

Table 11. India: Automotive Electrical Connectors Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 12. India: Automotive Electrical Connectors Market, by Vehicle Type – Revenue and Forecast to 2028 (US$ Million)

Table 13. India: Automotive Electrical Connectors Market, by Powertrain Type – Revenue and Forecast to 2028 (US$ Million)

Table 14. South Korea: Automotive Electrical Connectors Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 15. South Korea: Automotive Electrical Connectors Market, by Vehicle Type – Revenue and Forecast to 2028 (US$ Million)

Table 16. South Korea: Automotive Electrical Connectors Market, by Powertrain Type – Revenue and Forecast to 2028 (US$ Million)

Table 17. Australia: Automotive Electrical Connectors Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 18. Australia: Automotive Electrical Connectors Market, by Vehicle Type – Revenue and Forecast to 2028 (US$ Million)

Table 19. Australia: Automotive Electrical Connectors Market, by Powertrain Type – Revenue and Forecast to 2028 (US$ Million)

Table 20. Rest of APAC: Automotive Electrical Connectors Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 21. Rest of APAC: Automotive Electrical Connectors Market, by Vehicle Type – Revenue and Forecast to 2028 (US$ Million)

Table 22. Rest of APAC: Automotive Electrical Connectors Market, by Powertrain Type – Revenue and Forecast to 2028 (US$ Million)

Table 23. List of Abbreviation

LIST OF FIGURES

Figure 1. Automotive Electrical Connectors Market Segmentation

Figure 2. Automotive Electrical Connectors Market Segmentation – By Country

Figure 3. Asia Pacific Automotive Electrical Connectors Market Overview

Figure 4. Automotive Electrical Connectors Market, by Type

Figure 5. Automotive Electrical Connectors Market, By Powertrain Type

Figure 6. Automotive Electrical Connectors Market, By Country

Figure 7. Asia-Pacific – PEST Analysis

Figure 8. Automotive Electrical Connectors Market: Ecosystem Analysis

Figure 9. World Motor Vehicle Production – by Vehicle Type, Million

Figure 10. Automotive Electrical Connectors Market Impact Analysis of Drivers and Restraints

Figure 11. Automotive Electrical Connectors Market Revenue Forecast and Analysis (US$ Million)

Figure 12. Automotive Electrical Connectors Market, by Type (2020 & 2028)

Figure 13. Cable Lugs: Automotive Electrical Connectors Market Revenue and Forecast to 2028 (US$ Million)

Figure 14. Battery Clamps: Automotive Electrical Connectors Market Revenue and Forecast to 2028 (US$ Million)

Figure 15. High Voltage Busbars: Automotive Electrical Connectors Market Revenue and Forecast to 2028 (US$ Million)

Figure 16. Fuse Boxes: Automotive Electrical Connectors Market Revenue and Forecast to 2028 (US$ Million)

Figure 17. Automotive Electrical Connectors Market, by Vehicle Type (2020 & 2028)

Figure 18. Passenger Vehicle: Automotive Electrical Connectors Market Revenue and Forecast to 2028 (US$ Million)

Figure 19. Light Commercial Vehicle (LCV): Automotive Electrical Connectors Market Revenue and Forecast to 2028 (US$ Million)

Figure 20. Medium and Heavy Commercial Vehicle (M&HCV): Automotive Electrical Connectors Market Revenue and Forecast to 2028 (US$ Million)

Figure 21. Automotive Electrical Connectors Market, by Powertrain Type (2020 & 2028)

Figure 22. Internal Combustion Engine (ICE): Automotive Electrical Connectors Market Revenue and Forecast to 2028 (US$ Million)

Figure 23. Electric Vehicle (EV): Automotive Electrical Connectors Market Revenue and Forecast to 2028 (US$ Million)

Figure 24. Plug-In Hybrid Electric Vehicle (PHEV): Automotive Electrical Connectors Market Revenue and Forecast to 2028 (US$ Million)

Figure 25. Hybrid Electric Vehicle (HEV): Automotive Electrical Connectors Market Revenue and Forecast to 2028 (US$ Million)

Figure 26. APAC: Automotive Electrical Connectors Market – Revenue and Forecast to 2028 (US$ Million)

Figure 27. APAC: Automotive Electrical Connectors Market Revenue Share, by Type (2020 & 2028)

Figure 28. APAC: Automotive Electrical Connectors Market Revenue Share, by Vehicle Type (2020 & 2028)

Figure 29. APAC: Automotive Electrical Connectors Market Revenue Share, by Powertrain Type (2020 & 2028)

Figure 30. APAC: Automotive Electrical Connectors Market Revenue Share, by Key Country (2020 & 2028)

Figure 31. China: Automotive Electrical Connectors Market – Revenue and Forecast to 2028 (US$ Million)

Figure 32. Japan: Automotive Electrical Connectors Market – Revenue and Forecast to 2028 (US$ Million)

Figure 33. India: Automotive Electrical Connectors Market – Revenue and Forecast to 2028 (US$ Million)

Figure 34. South Korea: Automotive Electrical Connectors Market – Revenue and Forecast to 2028 (US$ Million)

Figure 35. Australia: Automotive Electrical Connectors Market – Revenue and Forecast to 2028 (US$ Million)

Figure 36. Rest of APAC: Automotive Electrical Connectors Market – Revenue and Forecast to 2028 (US$ Million)

Figure 37. Impact of COVID-19 Pandemic in Asia Pacific Country Markets

- INTERCABLE srl

- Connor Manufacturing

- Amphenol Corporation

- Emerson Electric Co.

- Rogers Corporation

- Molex, LLC

- TB&C

- Difvan

- TE Connectivity Ltd.

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the Asia Pacific automotive electrical connector market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the Asia Pacific automotive electrical connector market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin security interest with respect to client products, segmentation, pricing and distribution.