Asia Pacific Aramid Fiber Market for Automotive Hoses Forecast to 2028 - COVID-19 Impact and Regional Analysis By Type (Para-Aramid Fiber and Meta Aramid Fiber)

Market Introduction

The Asia Pacific aramid fiber market for automotive hoses is a highly fragmented market with the presence of considerable regional and local players providing numerous solutions for companies investing in the market arena. Electric vehicles require different kinds of hoses and fluid transmission assemblies than traditional internal combustion engine vehicles. Large battery electric vehicles generate a lot of heat, and many manufacturers use composite tubes to enclose the batteries and prevent their heat management. Electric vehicles tubes are typically much longer and narrower than traditional automotive tubes and electric vehicles also require many of the same hoses, pipe fittings, and assemblies as traditional vehicles, such as the air conditioning and brake lines. They also require special considerations to ensure appropriate performance in the operation of an electric vehicle. For instance, air conditioning hose assemblies can also be used in electric vehicles to carry refrigerant and lubricant between the components of the electric vehicle. These systems typically utilize both a pressure and return line. Further, increasing adoption of aramid fiber in electric vehicles, owing to several requirements by the automotive companies, such as replacing conventional substrates materials with synthetic substrates and increasing focus on environmental concerns. Aramid fibers are known for their temperature resistance, strength, reinforcement, and other properties that can help improve filters, belts, gaskets, and other automotive components. Thus, the rising adoption of electric vehicles is expected to provide lucrative opportunities for automotive hoses manufacturers in the market.

The COVID-19 outbreak created significant resistance to the automotive parts market in 2020, as trade restrictions disrupted the supply chain, and government blockades across the region reduced consumption of aramid fibers However, growing regional demand, government incentives, and easy raw materials availability are expected to drive the market growth over the forecast period. For example, India's Automotive Mission Plan FAME II emphasizes government support to the growing Indian automotive and parts manufacturing industry. In recent years, the automobile parts and accessories industry has undergone significant changes. The development of the auto parts manufacturing industry in Asia Pacific is driven primarily by the growing automotive industry, especially in China, South Korea, and India. The growing production of electric vehicles propels the demand for theirs parts and components, which would fuel the aramid fiber market for automotive hoses in the region during the forecast period.

Get more information on this report :

Market Overview and Dynamics

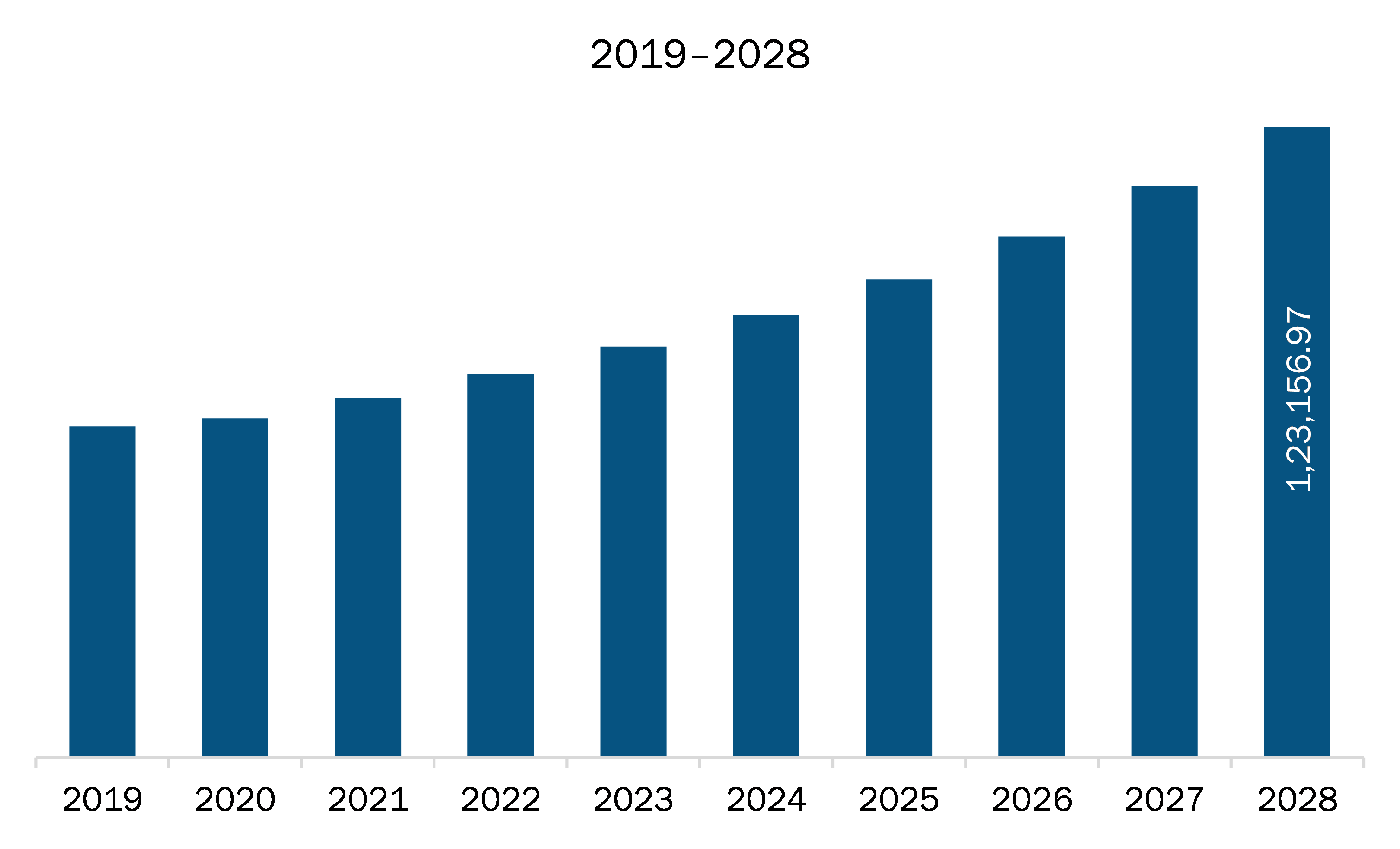

The aramid fiber market for automotive hoses in Asia Pacific is expected to grow from US$ 72,082.42 thousand in 2021 to US$ 1,23,156.97 thousand by 2028; it is estimated to grow at a CAGR of 8.0% from 2021 to 2028. The automotive industry uses a different type of materials such as iron, aluminum, plastic, steel, and glass to build cars and other vehicles. Aramid fibers are extensively used as a substitute for fiber glass and steel due to their lightweight, high tensile strength, and superior corrosion resistance in automotive hoses manufacturing. Manufacturers in the automotive industry are constantly looking to stay competitive by bringing innovative products to market. Safety aspects, excellent performance, and the need for sustainability, pressure the automotive industry to develop high-quality products. Today, automotive hoses have to perform well despite increasingly difficult conditions. For example, under-hood hose systems must withstand increasingly harsh operating conditions. Manufacturers are continuously innovating their products. For instance, Dupont provides knitted or braided Kevlar fiber for automobile hoses, which is used to reinforce radiator, gearbox, and turbocharger hoses to make them stronger and lighter. This is because Kevlar is not only stronger than other materials commonly used in high-pressure hoses, but it also has outstanding thermal stability and chemical resistance. In addition, Teijinconex offers meta-aramid for the extremely high-temperature circumstances on the hot side of the turbocharger for conveying high-temperature gases or fluids or supporting a high-pressure transmission system. Thus, the rising demand from the automotive industry is driving the aramid fiber market for automotive hoses

Key Market Segments

Based on type, the para-aramid fiber segment accounted for the largest share of the Asia Pacific aramid fiber market for automotive hoses in 2020.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the Asia Pacific aramid fiber market for automotive hoses are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report include DuPont de Nemours, Inc.; Teijin Limited; Continental AG; Kolon Industries Inc.; YOKOHAMA RUBBER CO., LTD.; Beaver Manufacturing Company; Artel Rubber Company; Gates Corporation; Norres and Huvis Corp.

Reasons to buy report

- To understand the Asia Pacific aramid fiber market for automotive hoses landscape and identify market segments that are most likely to guarantee a strong return

- Stay ahead of the race by comprehending the ever-changing competitive landscape for Asia Pacific aramid fiber market for automotive hoses

- Efficiently plan M&A and partnership deals in Asia Pacific aramid fiber market for automotive hoses by identifying market segments with the most promising probable sales

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form Asia Pacific aramid fiber market for automotive hoses

- Obtain market revenue forecast for market by various segments from 2019-2028 in Asia Pacific region.

Asia Pacific Aramid Fiber Market for Automotive Hoses Segmentation

Asia Pacific Aramid Fiber Market for Automotive Hoses – By Type- Para-Aramid Fiber

- Meta Aramid Fiber

Asia Pacific Aramid Fiber Market for Automotive Hoses – By Country

- Australia

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

Asia Pacific Aramid Fiber Market for Automotive Hoses – Company Profiles

- DuPont de Nemours, Inc.

- Teijin Limited

- Continental AG

- Kolon Industries Inc.

- YOKOHAMA RUBBER CO., LTD.

- Beaver Manufacturing Company

- Artel Rubber Company

- Gates Corporation

- Norres

- Huvis Corp.

TABLE OF CONTENTS

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Scope of the Study

3.2 Research Methodology

3.2.1 Data Collection

3.2.2 Primary Interviews

3.2.3 Hypothesis Formulation

3.2.4 Macro-economic Factor Analysis

3.2.5 Developing Base Number

3.2.6 Data Triangulation

3.2.7 Country Level Data

4. Asia Pacific Aramid Fiber Market for Automotive Hoses Landscape

4.1 Market Overview

4.2 Value Chain Analysis

4.3 Porter’s Five Forces Analysis

4.3.1 Bargaining Power of Suppliers

4.3.2 Bargaining Power of Buyers

4.3.3 Threat of Substitutes

4.3.4 Threat of New Entrants

4.3.5 Intensity of Competitive Rivalry

4.4 Expert Opinion

4.5 Qualitative Analysis on Vehicle Electrification

5. Aramid Fiber Market for Automotive Hoses – Key Market Dynamics

5.1 Market Drivers

5.1.1 Growing Application in Automotive Industry

5.1.2 Benefits Associated with Aramid Fibers

5.2 Market Restraints

5.2.1 Widescale Availability of Direct Substitute Together with High Manufacturing Cost

5.3 Market Opportunities

5.3.1 Surge in Adoption of Aramid Hoses in Electric Vehicles Production

5.4 Future Trends

5.4.1 Rising Demand for Lightweight Materials Offering Significant Emission Reduction in Vehicles

5.5 Impact Analysis of Drivers and Restraints

6. Aramid Fiber Market for Automotive Hoses – Asia Pacific Analysis

6.1 Asia Pacific Market Overview

6.2 Aramid Fiber Market for Automotive Hoses –Revenue and Forecast To 2028 (US$ Thousand)

7. Asia Pacific Aramid Fiber Market for Automotive Hoses Analysis – By Type

7.1 Overview

7.2 Aramid Fiber Market for Automotive Hoses, By Type (2020 and 2028)

7.3 Para-Aramid Fiber

7.3.1 Overview

7.3.2 Para-Aramid Fiber: Aramid Fiber Market for Automotive Hoses – Revenue and Forecast to 2028 (US$ Thousand)

7.4 Meta-Aramid Fiber

7.4.1 Overview

7.4.2 Meta-Aramid Fiber: Aramid Fiber for Automotive Hoses – Revenue and Forecast to 2028 (US$ Thousand)

8. Asia Pacific Aramid Fiber Market for Automotive Hoses– Country Analysis

8.1 Asia-Pacific: Aramid Fiber Market for Automotive Hoses

8.1.1 Asia-Pacific: Aramid Fiber Market for Automotive Hoses, by Key Country

8.1.1.1 China: Aramid Fiber Market for Automotive Hoses –Analysis and Forecast to 2028 (US$ Thousand)

8.1.1.1.1 China: Aramid Fiber Market for Automotive Hoses, by Type

8.1.1.2 Japan: Aramid Fiber Market for Automotive Hoses –Analysis and Forecast to 2028 (US$ Thousand)

8.1.1.2.1 Japan: Aramid Fiber Market for Automotive Hoses, by Type

8.1.1.3 South Korea: Aramid Fiber Market for Automotive Hoses –Analysis and Forecast to 2028 (US$ Thousand)

8.1.1.3.1 South Korea: Aramid Fiber Market for Automotive Hoses, by Type

8.1.1.4 India: Aramid Fiber Market for Automotive Hoses –Analysis and Forecast to 2028 (US$ Thousand)

8.1.1.4.1 India: Aramid Fiber Market for Automotive Hoses, by Type

8.1.1.5 Australia: Aramid Fiber Market for Automotive Hoses –Analysis and Forecast to 2028 (US$ Thousand)

8.1.1.5.1 Australia: Aramid Fiber Market for Automotive Hoses, by Type

8.1.1.6 Rest of Asia-Pacific: Aramid Fiber Market for Automotive Hoses –Analysis and Forecast to 2028 (US$ Thousand)

8.1.1.6.1 Rest of Asia-Pacific: Aramid Fiber Market for Automotive Hoses, by Type

9. Impact of COVID-19 Pandemic on Asia Pacific Aramid Fiber for Automotive Hoses Overview

9.1 Asia Pacific: Impact Assessment of COVID-19 Pandemic

10. Company Profiles

10.1 DuPont de Nemours, Inc.

10.1.1 Key Facts

10.1.2 Business Description

10.1.3 Products and Services

10.1.4 Financial Overview

10.1.5 SWOT Analysis

10.1.6 Key Developments

10.2 Teijin Limited

10.2.1 Key Facts

10.2.2 Business Description

10.2.3 Products and Services

10.2.4 Financial Overview

10.2.5 SWOT Analysis

10.2.6 Key Developments

10.3 Continental AG

10.3.1 Key Facts

10.3.2 Business Description

10.3.3 Products and Services

10.3.4 Financial Overview

10.3.5 SWOT Analysis

10.3.6 Key Developments

10.4 Kolon Industries Inc.

10.4.1 Key Facts

10.4.2 Business Description

10.4.3 Products and Services

10.4.4 Financial Overview

10.4.5 SWOT Analysis

10.4.6 Key Developments

10.5 YOKOHAMA RUBBER CO., LTD

10.5.1 Key Facts

10.5.2 Business Description

10.5.3 Products and Services

10.5.4 Financial Overview

10.5.5 SWOT Analysis

10.5.6 Key Developments

10.6 Beaver Manufacturing Company

10.6.1 Key Facts

10.6.2 Business Description

10.6.3 Products and Services

10.6.4 Financial Overview

10.6.5 SWOT Analysis

10.6.6 Key Developments

10.7 Artel Rubber Company

10.7.1 Key Facts

10.7.2 Business Description

10.7.3 Products and Services

10.7.4 Financial Overview

10.7.5 SWOT Analysis

10.7.6 Key Developments

10.8 Gates Corporation

10.8.1 Key Facts

10.8.2 Business Description

10.8.3 Products and Services

10.8.4 Financial Overview

10.8.5 SWOT Analysis

10.8.6 Key Developments

10.9 Norres

10.9.1 Key Facts

10.9.2 Business Description

10.9.3 Products and Services

10.9.4 Financial Overview

10.9.5 SWOT Analysis

10.9.6 Key Developments

10.10 Huvis Corp.

10.10.1 Key Facts

10.10.2 Business Description

10.10.3 Products and Services

10.10.4 Financial Overview

10.10.5 SWOT Analysis

10.10.6 Key Developments

11. Appendix

11.1 About The Insight Partners

11.2 Glossary of Terms

LIST OF TABLES

Table 1. Asia Pacific: Aramid Fiber Market for Automotive Hoses –Revenue and Forecast To 2028 (US$ Thousand)

Table 2. China Aramid Fiber Market for Automotive Hoses, by Type – Revenue and Forecast to 2028 (US$ Thousand)

Table 3. Japan Aramid Fiber Market for Automotive Hoses, by Type – Revenue and Forecast to 2028 (US$ Thousand)

Table 4. South Korea Aramid Fiber Market for Automotive Hoses, by Type – Revenue and Forecast to 2028 (US$ Thousand)

Table 5. India Aramid Fiber Market for Automotive Hoses, by Type – Revenue and Forecast to 2028 (US$ Thousand)

Table 6. Australia Aramid Fiber Market for Automotive Hoses, by Type – Revenue and Forecast to 2028 (US$ Thousand)

Table 7. Rest of Asia-Pacific Aramid Fiber Market for Automotive Hoses, by Type – Revenue and Forecast to 2028 (US$ Thousand)

Table 8. Glossary of Terms, Asia Pacific Aramid Fiber Market for Automotive Hoses

LIST OF FIGURES

Figure 1. Asia Pacific Aramid Fiber Market for Automotive Hoses Segmentation

Figure 2. Asia Pacific Aramid Fiber Market for Automotive Hoses Segmentation – By Country

Figure 3. Asia Pacific Aramid Fiber Market for Automotive Hoses Overview

Figure 4. Para-Aramid Fiber Segment Held Largest Share of Asia Pacific Aramid Fiber Market for Automotive Hoses

Figure 5. China Held Largest Share of Asia Pacific Aramid Fiber Market for Automotive Hoses

Figure 6. Asia Pacific Aramid Fiber Market for Automotive Hoses, Key Market Players

Figure 7. Aramid Fiber Market for Automotive Hoses, Value Chain Analysis

Figure 8. Porter’s Five Forces Analysis

Figure 9. Expert Opinion

Figure 10. Asia Pacific Aramid Fiber Market for Automotive Hoses Impact Analysis of Drivers and Restraints

Figure 11. Asia Pacific: Aramid Fiber Market for Automotive Hoses – Revenue and Forecast To 2028 (US$ Thousand)

Figure 12. Aramid Fiber Market for Automotive Hoses Revenue Share, By Type (2020 and 2028)

Figure 13. Para-Aramid Fiber: Aramid Fiber for Automotive Hoses – Revenue and Forecast To 2028 (US$ Thousand)

Figure 14. Meta-Aramid Fiber: Aramid Fiber Market for Automotive Hoses – Revenue and Forecast To 2028 (US$ Thousand)

Figure 15. Asia Pacific: Aramid Fiber Market for Automotive Hoses Market, by Key Country – Revenue (2020) (USD Thousand)

Figure 16. Asia-Pacific: Aramid Fiber Market for Automotive Hoses Revenue Share, by Key Country (2020 and 2028)

Figure 17. China: Aramid Fiber Market for Automotive Hoses –Revenue and Forecast to 2028 (US$ Thousand)

Figure 18. Japan: Aramid Fiber Market for Automotive Hoses –Revenue and Forecast to 2028 (US$ Thousand)

Figure 19. South Korea: Aramid Fiber Market for Automotive Hoses –Revenue and Forecast to 2028 (US$ Thousand)

Figure 20. India: Aramid Fiber Market for Automotive Hoses –Revenue and Forecast to 2028 (US$ Thousand)

Figure 21. Australia: Aramid Fiber Market for Automotive Hoses –Revenue and Forecast to 2028 (US$ Thousand)

Figure 22. Rest of Asia-Pacific: Aramid Fiber Market for Automotive Hoses –Revenue and Forecast to 2028 (US$ Thousand)

Figure 23. Impact of COVID-19 Pandemic in Asia Pacific Country Markets

- DuPont de Nemours, Inc.

- Teijin Limited

- Continental AG

- Kolon Industries Inc.

- YOKOHAMA RUBBER CO., LTD.

- Beaver Manufacturing Company

- Artel Rubber Company

- Gates Corporation

- Norres

- Huvis Corp.

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the Asia Pacific aramid fiber market for automotive hoses.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the Asia Pacific aramid fiber market for automotive hoses, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth Asia Pacific market trends and outlook coupled with the factors driving the Asia Pacific aramid fiber market for automotive hoses, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution