Asia Pacfic Gas Turbine Market Forecast to 2027 - COVID-19 Impact and Regional Analysis by Technology (Open Cycle and Combined Cycle), Capacity (Below 40 MW, 40-120 MW, 120-300 MW, and Above 300 MW), and Application (Power Generation, Oil and Gas, and Industrial)

Market Introduction

Gas Turbine is an internal combustion engine comprising combustion chambers that releases expanding gases, which further drive the blades of a turbine. The gas turbine converts natural gas and other liquids into mechanical energy. This energy then fuels generators to produce electrical energy. The various advantages associated with gas turbines are high power to weight ratio and low operations pressure. Despite being small in size, the gas turbines possess a high power rating. They reduce carbon emissions and release fewer emissions into the air as compared to other engines. Thus, to lower carbon emission by harnessing natural gas instead of coal and nuclear is expected to create a significant demand for gas turbine in the coming years, which is further anticipated to drive the gas turbine market.

Get more information on this report :

Market Overview and Dynamics

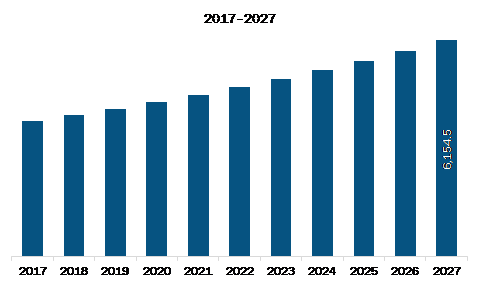

The gas turbine in APAC is expected to grow from US$ 4,031.3 Mn in 2019 to US$ 6.154.5 Mn by 2027; it is estimated to grow at a CAGR of 4.9% from 2020 to 2027. The organizations of people and resources are drifting away from the centralized system towards integrated networks that include both distributed and centralized elements. Electric power systems are riding the wave of decentralization through the deployment and use of distributed power technologies. Distributed power systems are being used and will continue to be used in the future to provide electrical and mechanical power to the nearest point of use. In the year 2012, $150 billion was distributed in distributed power technologies. This is bolstering the growth of the gas turbine market.

Key Market Segments

In terms of technology, the combined cycle segment accounted for the largest share of the APAC Gas turbine market in 2018. In terms of capacity, the 120-300 MW segment held a larger market share of the gas turbine in 2018. Further, the power generation held a larger share of the market based on application in 2018.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the gas turbine in APAC are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Ansaldo Energia S.p.A., General Electric Company, Harbin Electric Company Limited, Kawasaki Heavy Industries, Ltd., Man Energy Solutions, Mitsubishi Hitachi Power Systems, Ltd., Siemens AG, Solar Turbines Incorporated among others.

Reasons to buy report

- To understand the APAC gas turbine market landscape and identify market segments that are most likely to guarantee a strong return

- Stay ahead of the race by comprehending the ever-changing competitive landscape for APAC gas turbine market

- Efficiently plan M&A and partnership deals in APAC gas turbine market by identifying market segments with the most promising probable sales

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form APAC gas turbine market.

- Obtain market revenue forecast for market by various segments from 2020-2027 in APAC.

APAC GAS TURBINE MARKET SEGMENTATION

- Open Cycle

- Combined Cycle

- Below 40 MW

- 40-120 MW

- 120-300 MW

- Above 300 MW

- Power Generation

- Oil and Gas

- Industrial

By Country

- China

- Australia

- Japan

- India

- South Korea

- Rest of APAC

Company Profiles

- Ansaldo Energia S.p.A.

- General Electric Company

- Harbin Electric Company Limited

- Kawasaki Heavy Industries, Ltd.

- Man Energy Solutions

- Mitsubishi Hitachi Power Systems, Ltd.

- Siemens AG

- Solar Turbines Incorporated

- Wärtsilä Corporation

- Bharat Heavy Electricals Limited (BHEL)

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Scope of the Study

3.2 Research Methodology

3.2.1 Data Collection:

3.2.2 Primary Interviews:

3.2.3 Hypothesis formulation:

3.2.4 Macro-economic factor analysis:

3.2.5 Developing base number:

3.2.6 Data Triangulation:

3.2.7 Country level data:

4. Gas Turbine Market Landscape

4.1 Market Overview

4.2 APAC PEST Analysis

4.3 Expert Opinion

5. APAC Gas Turbine Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 To lower carbon emission by harnessing natural gas instead of coal and nuclear.

5.1.2 Incremental rise in demand of electricity in APAC due to rapid urbanization and industrialization.

5.2 Market Restraints

5.2.1 Inconsistent supply chain of natural gas for energy generation.

5.3 Market Opportunities

5.3.1 Upswing focus towards distributed power generation

5.4 Future Trends

5.4.1 Swift in trend of electricity generation and consumption

5.5 Impact Analysis

6. Gas Turbine–Market Analysis

6.1 Overview

6.2 APAC Gas Turbine Market–Revenue and Forecast to 2027 (US$ Mn)

6.3 Market Positioning –Market Players

7. Gas Turbine Market Analysis – By Technology

7.1 Overview

7.2 APAC Gas Turbine Market, By Technology (2018 and 2027)

7.3 Open Cycle

7.3.1 Overview

7.3.1.1 Open Cycle: Gas Turbine Market – Revenue, and Forecast to 2027 (US$ Million)

7.4 Combined Cycle

7.4.1 Overview

7.4.1.1 Combined Cycle: Gas Turbine Market – Revenue, and Forecast to 2027 (US$ Million)

8. Gas Turbine Market Analysis – By Capacity

8.1 Overview

8.2 APAC Gas Turbine Market, By Capacity (2018 and 2027)

8.3 Below 40 MW

8.3.1 Overview

8.3.1.1 Below 40 MW: Gas Turbine Market – Revenue and Forecast to 2027 (US$ Million)

8.4 - 120 MW

8.4.1 Overview

8.4.1.1 - 120 MW: Gas Turbine Market – Revenue and Forecast to 2027 (US$ Million)

8.5 - 300 MW

8.5.1 Overview

8.5.1.1 - 300 MW: Gas Turbine Market – Revenue and Forecast to 2027 (US$ Million)

8.6 Above 300 MW

8.6.1 Overview

8.6.1.1 Above 300 MW: Gas Turbine Market – Revenue and Forecast to 2027 (US$ Million)

9. Gas Turbine Market Analysis – By Application

9.1 Overview

9.2 APAC Gas Turbine Market, By Application (2018 and 2027)

9.3 Power Generation

9.3.1 Overview

9.3.2 Power Generation: Gas Turbine Market – Revenue and Forecast to 2027 (US$ Million)

9.4 Oil and Gas

9.4.1 Overview

9.4.2 Oil and Gas: Gas Turbine Market – Revenue and Forecast to 2027 (US$ Million)

9.5 Industrial

9.5.1 Overview

9.5.2 Industrial: Gas Turbine Market – Revenue and Forecast to 2027 (US$ Million)

10. Gas Turbine Market – Country Analysis

10.1 Overview

10.1.1.1 Australia: Gas Turbine Market –Revenue and Forecast to 2027 (US$ Million)

10.1.1.1.1 Australia: Gas Turbine Market, by Technology

10.1.1.1.2 Australia: Gas Turbine Market, by Capacity

10.1.1.1.3 Australia: Gas Turbine Market, by Application

10.1.1.2 China: Gas Turbine Market –Revenue and Forecast to 2027 (US$ Million)

10.1.1.2.1 China: Gas Turbine Market, by Technology

10.1.1.2.2 China: Gas Turbine Market, by Capacity

10.1.1.2.3 China: Gas Turbine Market, by Application

10.1.1.3 India: Gas Turbine Market –Revenue and Forecast to 2027 (US$ Million)

10.1.1.3.1 India: Gas Turbine Market, by Technology

10.1.1.3.2 India: Gas Turbine Market, by Capacity

10.1.1.3.3 India: Gas Turbine Market, by Application

10.1.1.4 Japan: Gas Turbine Market –Revenue and Forecast to 2027 (US$ Million)

10.1.1.4.1 Japan: Gas Turbine Market, by Technology

10.1.1.4.2 Japan: Gas Turbine Market, by Capacity

10.1.1.4.3 Japan: Gas Turbine Market, by Application

10.1.1.5 South Korea: Gas Turbine Market –Revenue and Forecast to 2027 (US$ Million)

10.1.1.5.1 South Korea: Gas Turbine Market, by Technology

10.1.1.5.2 South Korea: Gas Turbine Market, by Capacity

10.1.1.5.3 South Korea: Gas Turbine Market, by Application

10.1.1.6 Rest of APAC: Gas Turbine Market –Revenue and Forecast to 2027 (US$ Million)

10.1.1.6.1 Rest of APAC: Gas Turbine Market, by Technology

10.1.1.6.2 Rest of APAC: Gas Turbine Market, by Capacity

10.1.1.6.3 Rest of APAC: Gas Turbine Market, by Application

11. Impact of COVID-19 Pandemic on APAC Gas Turbine Market

11.1 Overview

11.2 Asia-Pacific: Impact assessment of COVID-19 Pandemic

12. Industry Landscape

12.1 Strategy and Business Planning

12.2 Collaboration

12.3 Product Launch

13. Company Profiles

13.1 Ansaldo Energia S.p.A.

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 General Electric Company

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Harbin Electric Company Limited

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.4 Kawasaki Heavy Industries, Ltd.

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.5 Man Energy Solutions

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.6 Mitsubishi Hitachi Power Systems, Ltd.

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 Siemens AG

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.8 Solar Turbines Incorporated

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.9 Wärtsilä Corporation

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.10 Bharat Heavy Electricals Limited (BHEL)

13.10.1 Key Facts

13.10.2 Business Description

13.10.3 Products and Services

13.10.4 Financial Overview

13.10.5 SWOT Analysis

14. Appendix

14.1 About The Insight Partners

14.2 Word Index

LIST OF TABLES

Table 1. APAC Gas Turbine Market –Revenue and Forecast to 2027 (US$ Mn)

Table 2. Australia Gas Turbine Market, by Technology – Revenue and Forecast to 2027 (USD Million)

Table 3. Australia Gas Turbine Market, by Capacity – Revenue and Forecast to 2027 (USD Million)

Table 4. Australia Gas Turbine Market, by Application – Revenue and Forecast to 2027 (USD Million)

Table 5. China Gas Turbine Market, by Technology – Revenue and Forecast to 2027 (USD Million)

Table 6. China Gas Turbine Market, by Capacity – Revenue and Forecast to 2027 (USD Million)

Table 7. China Gas Turbine Market, by Application – Revenue and Forecast to 2027 (USD Million)

Table 8. India Gas Turbine Market, by Technology – Revenue and Forecast to 2027 (USD Million)

Table 9. India Gas Turbine Market, by Capacity – Revenue and Forecast to 2027 (USD Million)

Table 10. India Gas Turbine Market, by Application – Revenue and Forecast to 2027 (USD Million)

Table 11. Japan Gas Turbine Market, by Technology – Revenue and Forecast to 2027 (USD Million)

Table 12. Japan Gas Turbine Market, by Capacity – Revenue and Forecast to 2027 (USD Million)

Table 13. Japan Gas Turbine Market, by Application – Revenue and Forecast to 2027 (USD Million)

Table 14. South Korea Gas Turbine Market, by Technology – Revenue and Forecast to 2027 (USD Million)

Table 15. South Korea Gas Turbine Market, by Capacity – Revenue and Forecast to 2027 (USD Million)

Table 16. South Korea Gas Turbine Market, by Application – Revenue and Forecast to 2027 (USD Million)

Table 17. Rest of APAC Gas Turbine Market, by Technology – Revenue and Forecast to 2027 (USD Million)

Table 18. Rest of APAC Gas Turbine Market, by Capacity – Revenue and Forecast to 2027 (USD Million)

Table 19. Rest of APAC Gas Turbine Market, by Application – Revenue and Forecast to 2027 (USD Million)

Table 20. List of Abbreviation

LIST OF FIGURES

Figure 1. APAC Gas Turbine Market Segmentation

Figure 2. APAC Gas Turbine Market Overview

Figure 3. Combined Cycle Segment Held Largest Share of APAC Gas Turbine Market

Figure 4. Power Generation Segment Held Largest Share of APAC Gas Turbine Market

Figure 5. -300 MW Segment Held Largest Share of APAC Gas Turbine Market

Figure 6. China Held Largest Share of APAC Gas Turbine Market

Figure 7. APAC: PEST Analysis

Figure 8. Expert Opinion

Figure 9. APAC Gas turbine Market: Impact Analysis of Drivers and Restraints

Figure 10. APAC Gas Turbine Market – Revenue and Forecast to 2027 (US$ Mn)

Figure 11. APAC Gas Turbine Market Revenue Share, by Technology (2018 and 2027)

Figure 12. APAC Open Cycle: Gas Turbine Market – Revenue, and Forecast to 2027 (US$ Million)

Figure 13. APAC Combined Cycle: Gas Turbine Market – Revenue, and Forecast to 2027 (US$ Million)

Figure 14. APAC Gas Turbine Market Revenue Share, by Capacity (2018 and 2027)

Figure 15. Below 40 MW: APAC Gas Turbine Market – Revenue, and Forecast to 2027 (US$ Million)

Figure 16. - 120 MW: APAC Gas Turbine Market –Revenue and Forecast to 2027 (US$ Million)

Figure 17. - 300 MW: APAC Gas Turbine Market –Revenue and Forecast to 2027 (US$ Million)

Figure 18. Above 300 MW: APAC Gas Turbine Market –Revenue and Forecast to 2027 (US$ Million)

Figure 19. APAC Gas Turbine Market Revenue Share, by Application (2018 and 2027)

Figure 20. APAC Power Generation: Gas Turbine Market – Revenue and Forecast to 2027 (US$ Million)

Figure 21. APAC Oil and Gas: Gas Turbine Market – Revenue and Forecast to 2027 (US$ Million)

Figure 22. APAC Industrial: Gas Turbine Market – Revenue and Forecast to 2027 (US$ Million)

Figure 23. Australia: Gas Turbine Market –Revenue and Forecast to 2027 (US$ Million)

Figure 24. China: Gas Turbine Market –Revenue and Forecast to 2027 (US$ Million)

Figure 25. India: Gas Turbine Market –Revenue and Forecast to 2027 (US$ Million)

Figure 26. Japan: Gas Turbine Market –Revenue and Forecast to 2027 (US$ Million)

Figure 27. South Korea: Gas Turbine Market –Revenue and Forecast to 2027 (US$ Million)

Figure 28. Rest of APAC: Gas Turbine Market –Revenue and Forecast to 2027 (US$ Million)

Figure 29. Impact of COVID-19 Pandemic in Asia Pacific Country Markets

- Ansaldo Energia S.p.A.

- General Electric Company

- Harbin Electric Company Limited

- Kawasaki Heavy Industries, Ltd.

- Man Energy Solutions

- Mitsubishi Hitachi Power Systems, Ltd.

- Siemens AG

- Solar Turbines Incorporated

- Wärtsilä Corporation

- Bharat Heavy Electricals Limited (BHEL)

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the APAC gas turbine market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the APAC Gas Turbine market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth APAC market trends and outlook coupled with the factors driving the gas turbine market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution.